The crypto market can be very crazy. Today you are cashing out big time, and the next day, you could be all to nothing. A recent case study is Terra Luna’s massive crash, in which many crypto enthusiasts and investors lost a lot of money.

LUNA was among the top 10 cryptocurrencies at the time before the incident. While the crash details are not our concern, you must understand that you cannot trust the crypto market. Even if Elon Musk is the owner of the crypto/token you plan to hodl, you must hodl with your eyes open.

That said, this article introduces you to several relevant reasons why you should not rely entirely on trading cryptocurrencies; and why you should try out alternative crypto investment tools.

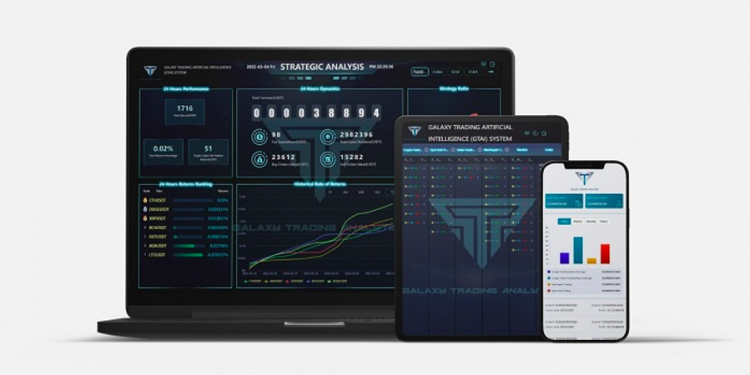

By the end of this article, you will learn about Galaxy Trading Analytics AI trading system (GTAI), a user-friendly mobile App, giving them the best yield in the crypto markets with minimal risks.

Why you must not rely entirely on cryptocurrency trading

Here are some relevant reasons you should reconsider spending your entire time, energy, and resources trading cryptocurrencies on CEXs or DEXs.

Too many fees apply

Fees are the primary source of revenue for both centralised and decentralised exchanges (CEXs and DEXs). A centralised exchange may charge spreads, trading fees, or in-house fees for product usage or sales. For DEXs, it could be through gas fees or liquidity pools. Whatever option you choose, you’ll always arrive at a fee. Depending on the market or network conditions, the fees could be outrageous and affect your net income.

Requires expertise, time, and energy

Trading digital currencies or even digital stocks requires expertise, time, and energy. Else you could spend the whole day at a loss or win depending on how favourable the market is that day. By trading cryptocurrencies, we can invest time, energy, and resources in other profitable activities or personal development.

Alternative crypto income streams to consider

After looking at the above reasons to consider alternative crypto-based income streams, here are a few suggestions to grow the portfolio in the cryptoverse.

Staking

Staking is popular with Proof of Stake (PoS) protocols or networks, such as Cardano, Binance, Solana, Tezos, Tron, etc. It is less energy and resource-intensive—requiring using only your asset to validate transactions on the protocol. You could earn adequate rewards when you successfully participate in staking.

Yield Farming

Yield Farming is like staking, only that it runs a special smart contract for the protocol. In yield farming, you supply collateral or liquidity to facilitate lending and borrowing using liquidity pool (LP) tokens. At the end of the day, you smile at an ample interest rate.

NFT trading

Trading NFT is quite different from trading cryptocurrencies on CEXs and DEXs. Although, it may not be as lucrative as normal crypto trading in a P2P, CEX, or DEX. NFT trading, like many other blockchain creations, has created passive income for creators through royalties or connections on social media.

The All-In-One Solution: GTAI

Galaxy Trading Artificial Intelligence (GTAI) is a world-class AI trading plus arbitrage system designed to help crypto traders maximize trading profits while minimizing risks and losses. Galaxy Trading Analytics (GTA), the leading regulated Fintech company founded in 2022 by a team of AI and Deep Learning experts that created the Bot. They have constructed a clear and transparent system that conducts trading transactions according to the parameters set, and have connected investment tools and financial protection algorithms to it. There are currently 4 proprietary trading and arbitrage strategies implemented, with more trading strategies that are currently being developed and will be added to GTAI once more stringent tests are being done.

Traders can choose between two Packages, A or B in their user-friendly App, where in Package A, the only thing traders need to do is set perimeters of the AI Bot and let the Bot do its work, while traders control 100% of their funds in their crypto exchange accounts. GTA claims that traders’ monthly estimated gains could be between 2% to 8% depending on crypto market conditions.

Traders can also go for Package B, where traders will get access to a dedicated team to monitor their trading on their behalf, deploying the right strategies according to the market movement. There will also be active risk management in place, 24 hours a day. Package B also grants access to higher leverage using liquidity pools, which means higher and more consistent profits by more powerful AI bot, going between 3% to 36% monthly gains. Both options can be selected at the same time, they are suitable for beginners, advanced or expert traders, and participation start from as low as $100.