Against the backdrop of increasing global demands for transparency, security, and regulatory compliance in the digital asset market, the decentralized cryptocurrency futures trading platform UIDI has recently attracted widespread industry attention. On September 9, 2025, UIDI announced that it had officially obtained the MSB (Money Services Business) license issued by the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN). The platform also confirmed that its registered user base has exceeded 1 million. This dual milestone in regulatory compliance and user growth represents a significant phase achievement for UIDI in its journey toward internationalization and adherence to regulatory standards.

The MSB license is a highly authoritative financial services qualification at the U.S. federal level and serves as a critical prerequisite for enterprises to conduct virtual currency trading, fund transfers, and payment-related businesses in the U.S. and its relevant territories. Obtaining this license requires meeting multiple compliance requirements, including adherence to the Bank Secrecy Act (BSA), establishment of comprehensive anti-money laundering (AML) and counter-terrorism financing (CTF) frameworks, appointment of dedicated compliance personnel, and successful completion of independent third-party audits. Given that FinCEN’s regulatory system is globally recognized for its strictness in the virtual asset industry, passing its review typically signifies that a company has achieved high standards in risk management, internal governance, and information transparency.

UIDI stated that acquiring the MSB license not only validates the platform’s capabilities in compliance governance but also lays the institutional foundation for legally providing related financial services in the U.S. market. With the license in place, UIDI is advancing the next phase of its global compliance strategy, planning to gradually apply for relevant licenses in major jurisdictions, including the UK FCA, EU MiCA, Singapore MAS, and Hong Kong VASP, to build a multi-regional compliant operational network.

In terms of business development, UIDI has maintained rapid user growth. According to platform data, its global registered user base has exceeded 1 million. The platform currently supports over 50 major and emerging cryptocurrency futures trading pairs and plans to expand its product offerings in later stages to tokenized derivatives of traditional financial assets, such as U.S. stocks and ETFs. By leveraging on-chain verifiable trading structures, multi-asset settlement support, and a 1:1 real custodial mechanism, UIDI aims to provide a relatively fair, transparent, and efficient trading environment for users worldwide.

As a platform built around decentralization and on-chain transparency, UIDI emphasizes that all transactions are executed automatically through smart contracts, with relevant data publicly accessible and independently verifiable. This model reduces reliance on centralized intermediaries to a certain extent and, against the backdrop of increasing industry focus on trading platform security in recent years, has earned greater recognition from both users and institutions.

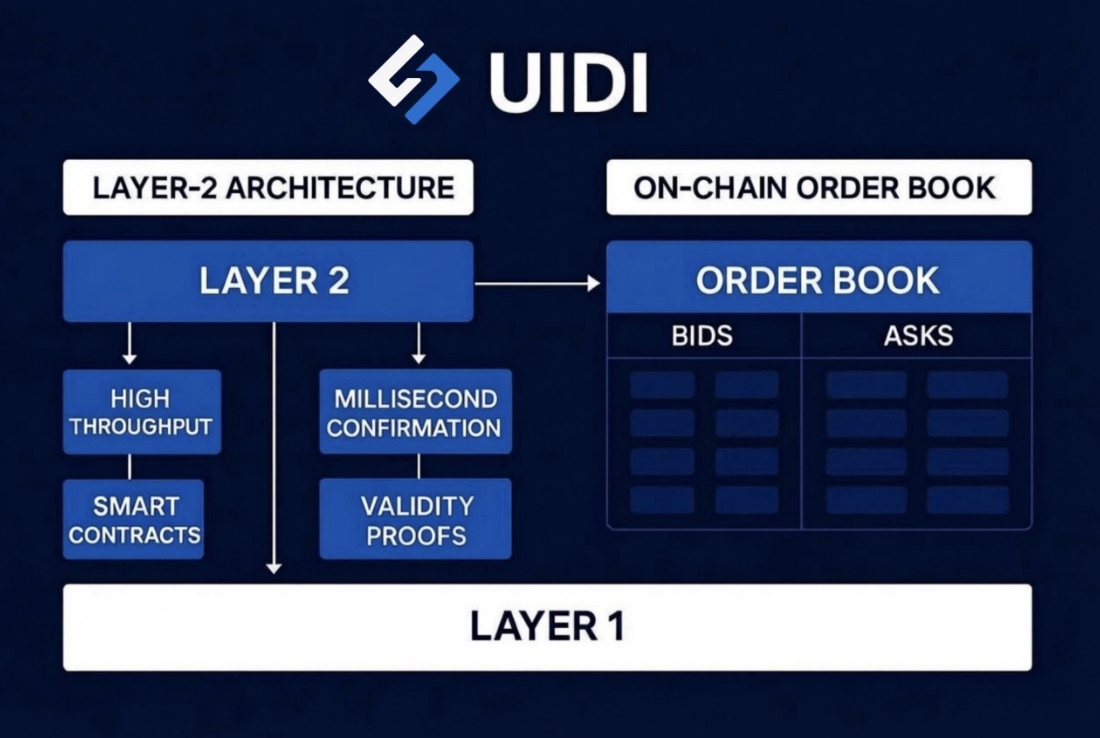

From a technical architecture perspective, the UIDI platform is built on a self-developed Layer-2 blockchain network specifically designed for high-frequency financial trading scenarios. It supports millisecond-level confirmation speeds and high throughput, enabling large-scale on-chain perpetual contract trading. Unlike most decentralized trading platforms that rely on AMM models, UIDI employs an on-chain order book mechanism. This approach improves matching efficiency while mitigating issues such as slippage and insufficient liquidity, effectively combining a decentralized structure with an execution experience close to that of centralized exchanges.

In addition, UIDI has implemented targeted optimizations to enhance user experience. Through mechanisms such as session-based authorization, the platform reduces operational complexity caused by frequent signature requests, allowing on-chain trading to maintain the advantages of self-custody while providing a user experience closer to that of centralized platforms. Currently, UIDI offers perpetual contract products with up to 200x leverage and covers spot trading as well as pre-launch markets for new assets, forming a relatively comprehensive product ecosystem. Its team comprises professionals from leading technology companies and financial institutions, with a strong focus on addressing long-standing challenges in decentralized finance related to performance, transparency, and scalability.

Industry experts note that UIDI’s simultaneous progress in compliance, user growth, and technological development reflects broader trends in the decentralized derivatives sector. As global regulatory frameworks gradually mature, competition among virtual asset platforms is shifting from singular product capabilities toward building robust compliance systems, transparent mechanisms, and sustainable long-term operations. UIDI’s initiatives are regarded as an important case study in the exploration of next-generation on-chain financial infrastructure.

Looking ahead, UIDI stated that it will continue to advance platform development with a focus on compliance governance, risk management, and technological stability, steadily expanding its global business footprint within existing regulatory frameworks. By continuously optimizing on-chain infrastructure and trading mechanisms, the platform aims to enhance transparency and operational efficiency in the decentralized derivatives market while meeting compliance requirements across different jurisdictions. These initiatives are also regarded as UIDI’s exploration and practical implementation of a long-term sustainable operational model amid the gradually clarifying global digital asset regulatory landscape.